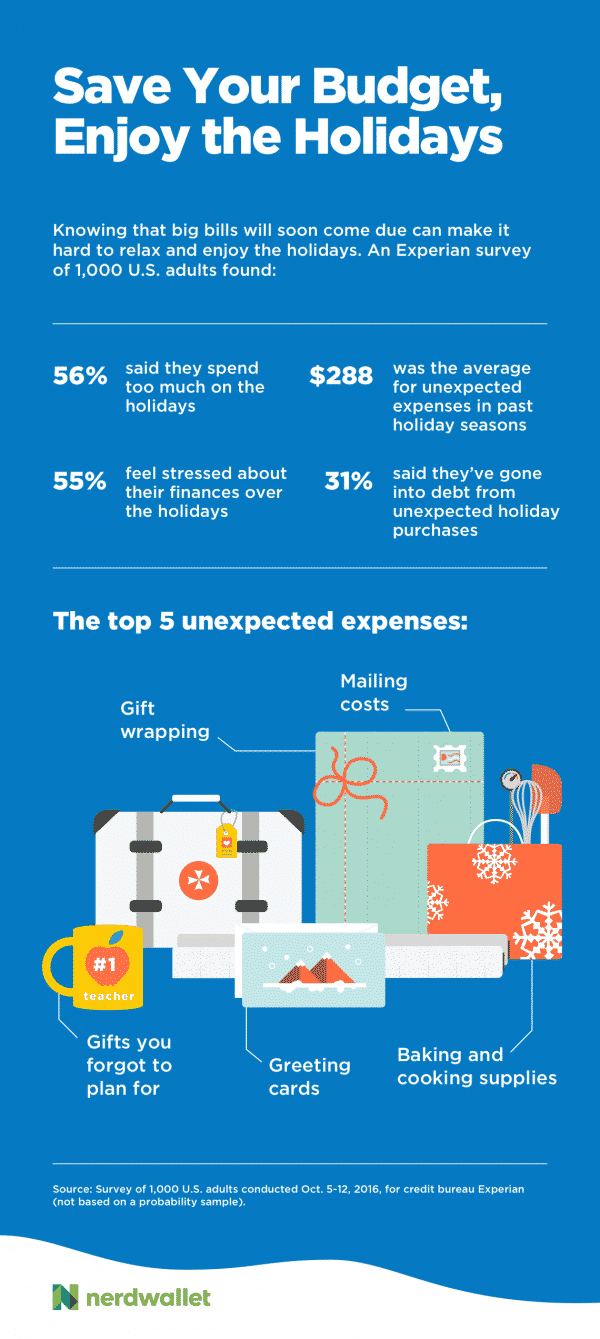

5 Frugality Pros Help You Rein In Holiday SpendingThe overflowing expectations around the holidays can entice us to spend more than we can afford. Not only do we have bills to face once the decorations are put away, but 43% of respondents to an Experian survey say extra expenses also make the holidays hard to enjoy.Now’s the time to plan so your December spirit doesn’t lead to January bills. We asked five experts on frugality what they do to avoid…

5 Frugality Pros Help You Rein In Holiday SpendingThe overflowing expectations around the holidays can entice us to spend more than we can afford. Not only do we have bills to face once the decorations are put away, but 43% of respondents to an Experian survey say extra expenses also make the holidays hard to enjoy.Now’s the time to plan so your December spirit doesn’t lead to January bills. We asked five experts on frugality what they do to avoid…

Why You Shouldn’t Be Spooked by Student Loans If you’ve heard common student-loan horror stories, you might think that borrowing for school will leave you owing six figures, facing arrest for failure to pay and shackling your family to your debt even if you die. But those are extreme cases. Student loans are a smart career investment as long as you borrow in moderation and graduate. In the media: Ghoulish debt examples Your perception of the normal amount of student…

READ MOREHow to Buy a New Car

Aug 5, 2017

How to Buy a New Car The number of decisions you have to make when buying a new car can be dizzying. And while many of them will depend on your individual needs and wants, there are some steps you should take no matter what to ensure you get the best deal. Assess your credit and financing options Unless you plan to pay cash, your credit will matter a great deal as you look for financing. Get your (free) credit…

READ MOREGreenPath March 2017 – Pathways

Mar 5, 2017

Have you enrolled your account for Bill Pay yet? It’s the quick and easy way to make sure all your bills are paid on time electronically! We offer this service in your online banking. GreenPath and Forbes have some helpful tips this month for using this service to its best ability!Four To-Do’s for Effective Bill PayingThe Federal Reserve recently estimated that nearly half of US households are unable to pay their credit card bills in full each month, and owe…

READ MORETis The Season – Nefe.org

Nov 14, 2016

As the Holidays get closer we thought it might be a good idea to share with you a few tips to help you manage your spending during the Holiday season! This month’s blog comes from an article on NEFE.org.Make a budget and commit: List all of the gifts and decorations you plan to buy, the parties you will attend and the travel expenses you anticipate. Do not exceed your preset limits.Make a gift list and check it twice: List all…

READ MORECard Valet

Jun 10, 2016