When the COVID-19 pandemic hit last year, people were overwhelmed by the logistics of sudden and swift stay-at-home orders. Between school closures, supply shortages and new ways of working, there was little time for much else. As many adjusted their spending habits, they also took the time to think more critically about their finances — and some of the government-mandated credit concessions made monitoring credit an especially good idea.

A new NerdWallet survey conducted online by The Harris Poll in September asked more than 2,000 Americans how they have managed their credit score during the pandemic, beginning in March 2020.

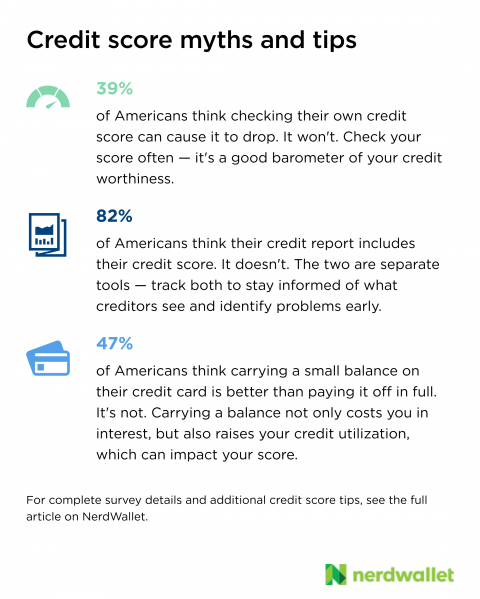

Respondents were also asked to identify common misconceptions about credit scores. The results reveal that plenty of misinformation about credit exists, but it’s possible to cut through the fog and build your score. The first step is some myth-busting.

Myth: Checking your credit score will hurt it

Although the survey shows nearly 2 in 5 Americans (39%) think checking their own credit score can cause it to drop, that’s not the case.

The confusion might come from the two types of credit checks, called inquiries. Your score is unaffected when you check it yourself or when a lender checks it to pre-qualify you for card offers and other marketing purposes. Those are called soft inquiries.

The other type, a hard inquiry, happens when a lender checks your credit because you’ve applied for a new line of credit. A hard inquiry can drop your score a few points, but the effect is only temporary.

Checking your own score regularly lets you track your credit and spot signs of trouble early.

Myth: Your credit score is on your credit report

The survey findings reveal that about 8 in 10 Americans (82%) incorrectly believe that their credit report includes a credit score. Those are two different tools, although they are closely related.

Your credit report contains details about your past credit use and other personal and financial information. Your credit score, on the other hand, is based on the data in your credit report. That score, usually on a scale from 300 to 850, helps potential lenders assess the risk involved in granting you credit.

You have access to both your:

- Credit report: You’re entitled to a free credit report weekly from each of the three major credit bureaus, and using AnnualCreditReport.com is the best way to request them. Reading your credit reports and disputing errors are good financial habits.

- Credit score: Many personal finance and banking websites offer a free credit score that you can use to monitor your progress.

Myth: Carrying a small balance on credit cards helps your score

Nearly half of Americans (47%) think that carrying a small credit card balance is better for their credit than paying it off each month, according to the survey. But all that does is cost you in interest. Paying off your balance in full also can help keep your debt load from creeping up higher than you can afford.

If you’re interested in building your score, try this approach instead: Make a few smaller payments each month or time payments with a paycheck or another influx of cash. Continually lowering card balances instead of waiting for the monthly bill helps keep your credit utilization low, which has a big influence on scores.

So, what’s true about scores and how to build them?

A few time-tested strategies will help you build your credit. Here’s how to focus your actions on the scoring factors that matter most.

Pay on time every time

Paying bills on time is essential for building credit or maintaining strong credit because payment history is the single most important factor in credit scores. In fact, a payment 30 days or more past due can drop a good credit score 100 points.

If you’re finding it hard to manage multiple due dates, try automating your payments — or at least minimum payments — so you don’t miss one.

Use credit lightly

Using a maximum of 30% of your credit limits is another key for building a strong credit score, although remaining under 10% is ideal. Stay on top of your credit usage by keeping your credit limits in mind as you spend. Two strategies that can help you stay below 30% are tracking your spending and setting balance alerts. Requesting a credit limit increase is another option to consider.

Pay off card balances in full each month

Paying off your credit cards every month saves you in interest and may help keep you from overspending. If paying off your balance once a month proves difficult, try making smaller payments a few times a month.

Keep your oldest credit accounts open

The longer your credit history, the less risky you seem to potential lenders. Keeping your older credit accounts open is a great way to show you have a long and established credit history.

If you’re new to credit, you can ask to be added as an authorized user on someone else’s credit card account. Choose someone who has an established account and an excellent credit score. That person’s account history and credit limits will be added to your credit reports.

More From NerdWallet

The article Building Your Credit: Myths and Reality originally appeared on NerdWallet.