What to Know About Home Equity Loans

Jan 5, 2018

What to Know About Home Equity Loans If you’re a homeowner, you have a powerful tool in your financial arsenal: the home equity loan. Home equity loans allow some consumers to borrow a large amount of money relatively easily and cheaply. But they aren’t right for all situations. Here’s a bit more about how they work and when they’re a good option. How home equity loans work A home equity loan is a loan secured by the value of the…

READ MORE

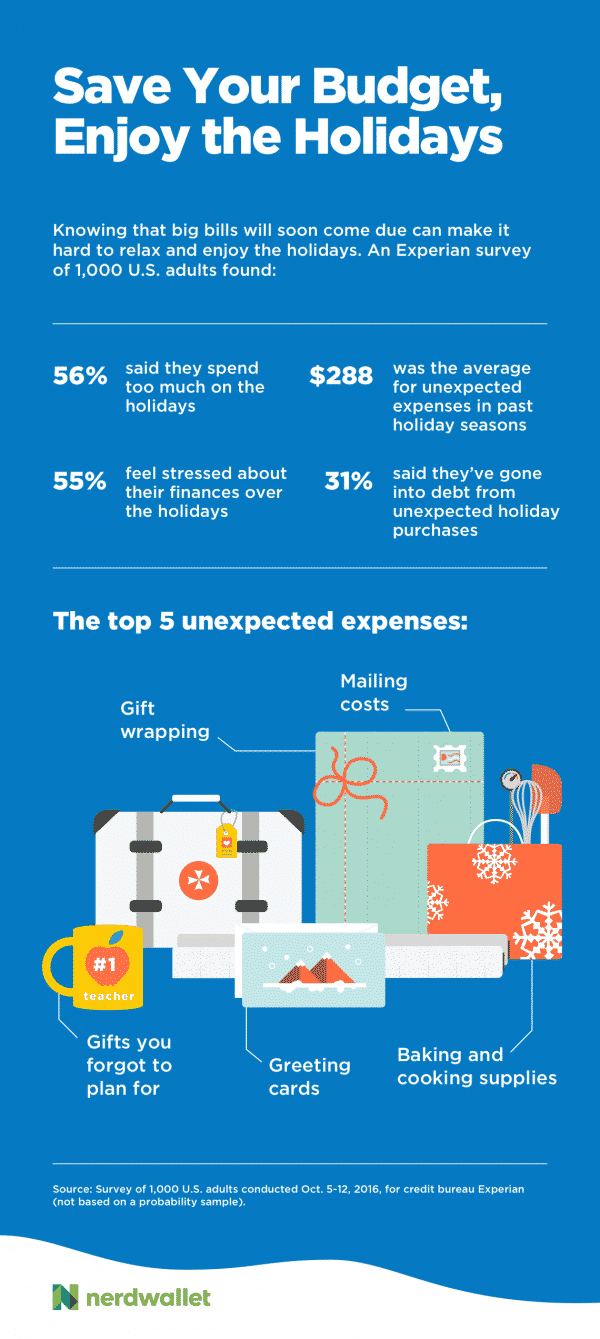

5 Frugality Pros Help You Rein In Holiday SpendingThe overflowing expectations around the holidays can entice us to spend more than we can afford. Not only do we have bills to face once the decorations are put away, but 43% of respondents to an Experian survey say extra expenses also make the holidays hard to enjoy.Now’s the time to plan so your December spirit doesn’t lead to January bills. We asked five experts on frugality what they do to avoid…

5 Frugality Pros Help You Rein In Holiday SpendingThe overflowing expectations around the holidays can entice us to spend more than we can afford. Not only do we have bills to face once the decorations are put away, but 43% of respondents to an Experian survey say extra expenses also make the holidays hard to enjoy.Now’s the time to plan so your December spirit doesn’t lead to January bills. We asked five experts on frugality what they do to avoid…