Best Ways to Save on Summer Vacation

Jun 12, 2018

Best Ways to Save on Summer Vacation With school letting out and sultry summer days ahead, it’s time to start thinking vacation. Because it’s a supply-and-demand world, you’ll likely be up against higher airfare, hotel costs and car rental rates. But here are some tips to help keep things affordable. If by air … If you plan to fly domestically, your best chance to score cheaper fares is by booking about 60 days in advance. For international travel, make it…

READ MORE

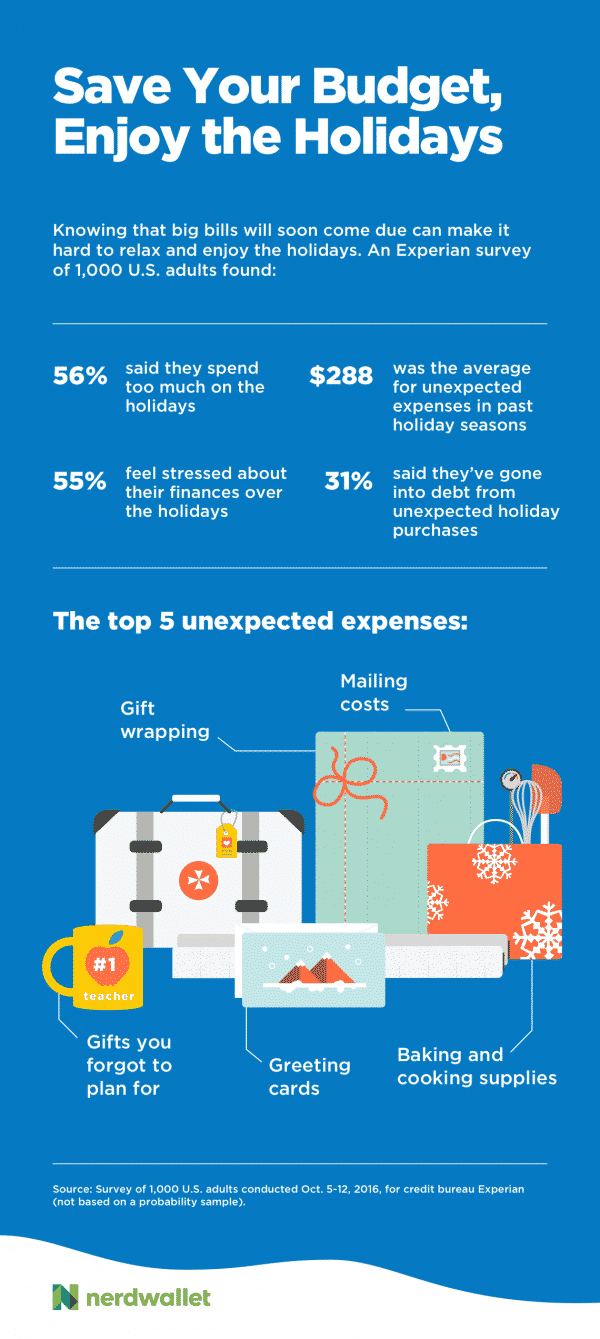

5 Frugality Pros Help You Rein In Holiday SpendingThe overflowing expectations around the holidays can entice us to spend more than we can afford. Not only do we have bills to face once the decorations are put away, but 43% of respondents to an Experian survey say extra expenses also make the holidays hard to enjoy.Now’s the time to plan so your December spirit doesn’t lead to January bills. We asked five experts on frugality what they do to avoid…

5 Frugality Pros Help You Rein In Holiday SpendingThe overflowing expectations around the holidays can entice us to spend more than we can afford. Not only do we have bills to face once the decorations are put away, but 43% of respondents to an Experian survey say extra expenses also make the holidays hard to enjoy.Now’s the time to plan so your December spirit doesn’t lead to January bills. We asked five experts on frugality what they do to avoid…